Featured

Table of Contents

As soon as you've discovered the ideal remote therapy job, it's time to prepare your digital practice for success. Below are the vital components to consider: Get a trustworthy, high-speed internet link (at least 10 Mbps), a computer system or laptop computer that meets your telehealth platform's needs, and a top quality webcam and microphone for clear video and audio.

Reserve a peaceful, exclusive area or space for your teletherapy sessions. Guarantee the location is well-lit, with a non-distracting background that represents your specialist setup. Usage noise-reducing methods and preserve confidentiality by avoiding interruptions throughout sessions. Readjust your therapeutic design to the online setting. Usage energetic listening, keep eye contact by taking a look at the cam, and take notice of your tone and body language.

Functioning remotely gets rid of the demand for a physical workplace, reducing expenses connected to rent, utilities, and maintenance. You also save time and cash on travelling, which can reduce tension and improve total health. Remote therapy enhances access to look after clients in backwoods, with limited mobility, or facing other barriers to in-person treatment.

Getting From Idea to Action

Working remotely can occasionally feel isolating, lacking face-to-face interactions with coworkers and clients. Taking care of client emergency situations or situations from a range can be tough. Telehealth needs clear protocols, emergency contacts, and experience with regional sources to make sure customer security and proper care.

Staying educated regarding changing telehealth regulations and best practices is necessary. Each state has its own laws and policies for teletherapy technique, including licensing requirements, informed permission, and insurance compensation. Keeping up with state-specific guidelines and acquiring necessary approvals is a continuous responsibility. To prosper long-lasting as a remote specialist, concentrate on growing expertly and adapting to the transforming telehealth atmosphere.

Launching Your Location-Independent Practice

A crossbreed version can offer flexibility, lower display fatigue, and enable for a more gradual shift to fully remote work. Attempt various combinations of online and face-to-face sessions to locate the best balance for you and your customers. As you browse your remote therapy profession, bear in mind to focus on self-care, established healthy and balanced borders, and seek support when required.

Research study constantly shows that remote treatment is as effective as in-person therapy for common psychological health conditions. As even more customers experience the comfort and convenience of obtaining treatment in the house, the approval and demand for remote solutions will certainly remain to grow. Remote therapists can earn competitive salaries, with possibility for higher earnings through expertise, exclusive technique, and occupation advancement.

Why This Wins for Your Bottom Line

We understand that it's handy to talk with an actual human when discussing website design firms, so we would certainly enjoy to arrange a time to talk to ensure we're a great mesh. Please fill in your details below so that a member of our team can assist you obtain this procedure started.

Tax obligation deductions can conserve self-employed specialists cash. Yet if you do not understand what qualifies as a cross out, you'll miss out on out. That's because, also if you track your deductible expenses, you require to maintain invoices on hand in order to report them. In case of an audit, the internal revenue service will certainly require receipts for your tax deductions.

There's a whole lot of argument among business proprietors (and their accounting professionals) regarding what comprises a company meal. Given that dishes were commonly abided in with enjoyment costs, this created a great deal of stress and anxiety among company proprietors that commonly subtracted it.

Usually, this suggests a dining establishment with either takeout or rest down service. Components for meal prep, or food purchased for anything apart from prompt consumption, do not qualify. To qualify, a meal has to be acquired during a service trip or shown an organization affiliate. Much more on organization travel deductions below.

What Research Says: Clinical Proof

Learn more about deducting service dishes. source If you travel for businessfor circumstances, to a conference, or in order to lecture or facilitate a workshopyou can subtract the majority of the prices. And you might even have the ability to press in some vacationing while you're at it. What's the distinction between a trip and a company trip? In order to qualify as business: Your trip must take you outside your tax home.

You have to be away for longer than one job day. The majority of your time ought to be spent doing company. If you are away for four days, and you spend three of those days at a seminar, and the fourth day sightseeing and tour, it counts as an organization journey. Reverse thatspend three days sightseeing, and one day at a conferenceand it's not a company journey.

You require to be able to confirm the trip was planned ahead of time. The IRS wants to avoid having service proprietors tack on professional tasks to leisure journeys in order to turn them right into overhead at the last moment. Preparing a composed travel plan and itinerary, and booking transportation and accommodations well in advance, helps to reveal the trip was largely organization related.

When making use of the mileage price, you don't consist of any type of various other expensessuch as oil adjustments or routine repair and maintenance. The only added automobile expenses you can subtract are parking charges and tolls. If this is your first year having your automobile, you need to calculate your deduction using the gas mileage rate.

Handling System Emergencies

If you exercise in an office outside your home, the cost of lease is totally insurance deductible. The expense of utilities (heat, water, electricity, web, phone) is also deductible.

Latest Posts

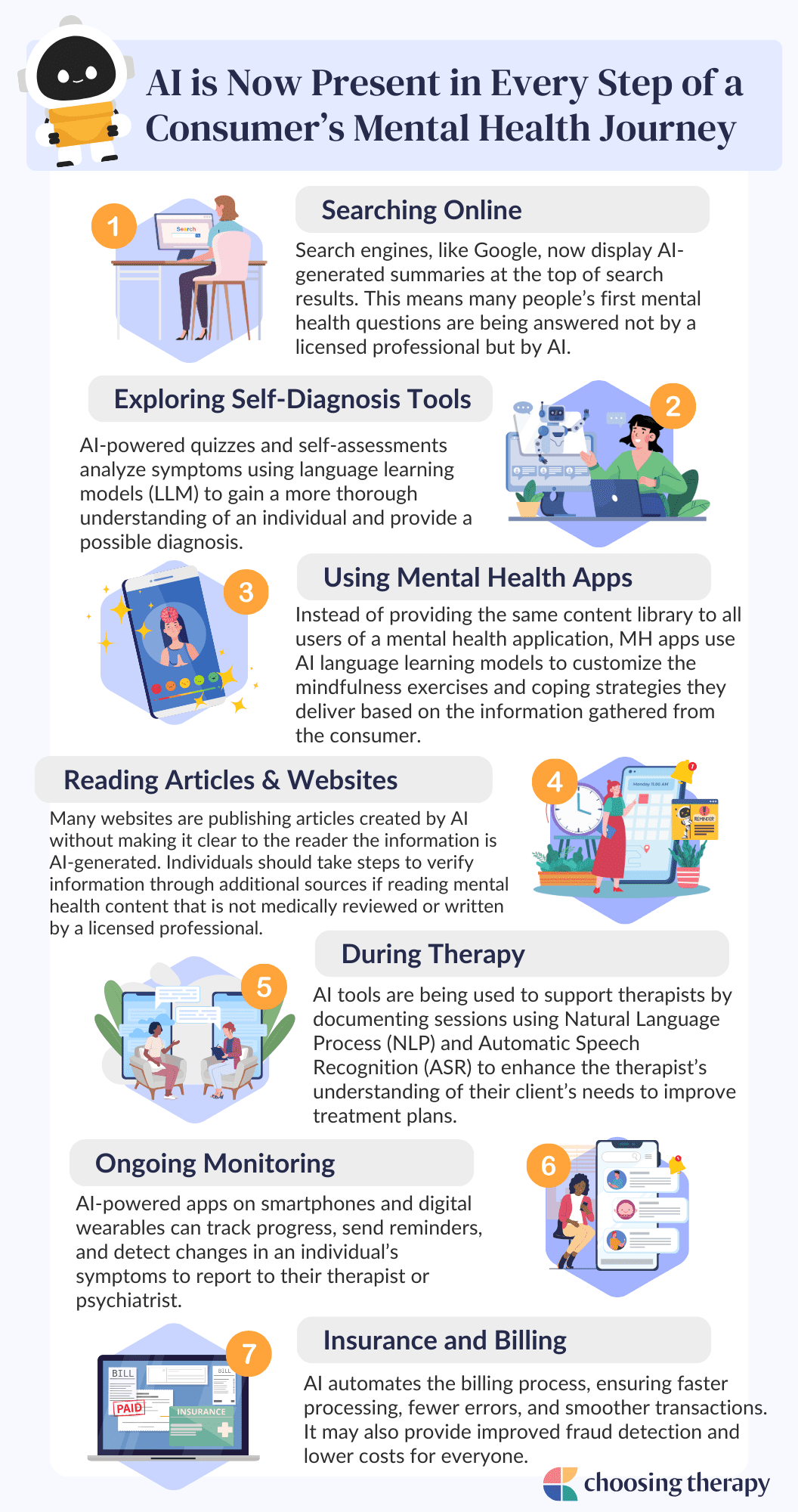

How Mental Health is Evolving

Technology for Location-Independent Therapy

Where Human Judgment Stays Essential